If this was forwarded to you, subscribe by clicking the box below:

Hello Everyone,

Digital currencies have generated more buzz than any other single technology in history, but along with popularity comes controversy. Whether you are a laser eyed net buyer holding the coins into perpetuity or someone who views the space as incredibly speculative, there are real world use cases that could solve some of the world’s greatest challenges.

Much like social media platforms when your grandparents join, things tend to fall out of favor when the government intervenes. But, so far, they are on the right track.

Given the technology’s potential to disrupt the financial sector for the better, countries around the world are moving quickly to develop, test, and launch their own stablecoins, Central Bank Digital Currencies (CBDC).

Unlike Bitcoin or other cryptocurrencies who sporadically fall victim to extreme price fluctuations, a stablecoin’s value is pegged to another asset like fiat currency or gold. To fix the antiquated monetary system we participate in, stablecoins are a necessary prerequisite, but alone are not sufficient. They must be combined with an underlying payments infrastructure that is cheaper, faster, and safer than the current, while also being programmable and transparent. To be truly revolutionary, CBDCs need to carry the benefits of cash on more efficient digital rails.

Managed and endorsed by the country’s national bank, CBDCs break down the barriers and enable greater access to the perks of modern, digital banking for low income people. According to a 2019 report from the Federal Reserve, 22% of adults were considered unbanked or underbanked – effectively barring them from participating in digital commerce. With CBDCs the 60 million Americans who cannot afford to be in the banking system and are therefore forced with the inconvenience of conducting economic activity with physical cash would be able to take part in the internet-based economy.

Worldwide, a total of 1.7 billion people do not have a bank account. Our global monetary system is extremely outdated and has proven to be resistant to innovation. We can and should build a solution to improve these unacceptable state of affairs and break the stalemate of decades of stagnation.

Stablecoins come with the attractive peer-to-peer properties of other cryptocurrencies, tearing down the middlemen’s barriers to entry, but also mitigating volatility. This tech has the potential to play an important role in the future of global finance and could become a backbone for payments and financial services.

Another use case for stablecoins comes in cross border payments and trading. When paying for imports or sending money abroad, the process often involves paperwork, hidden fees, and takes far too long.

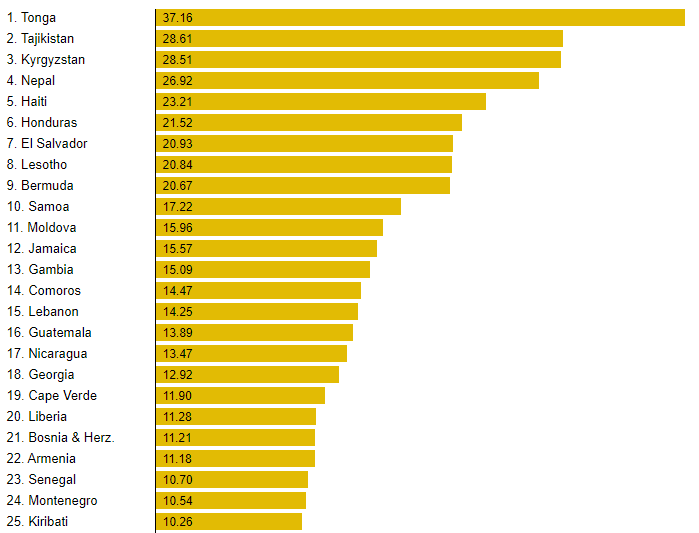

According to a study conducted by The World Bank, 25 countries show remittance payments as more than 10% of GDP:

This is a staggering number. Remittance payments are when a foreign worker transfers money back to friends or family in their home countries. Roughly $500 billion dollars in remittance payments are sent each year and about one in eight people worldwide are supported by funds sent home from migrant workers. In the world’s most fragile and conflicted countries, political unrest and economic turmoil can leave entire populations dependent on remittances.

Receiving international transfers is a complicated process since there is no single omnipresent system in place for routing money across borders. The average cost of remittance payments is roughly 6.5%, more than double the United Nation’s 2030 Sustainable Development Goals of less than 3%. Notwithstanding the exorbitant fees, international transfers typically require an arduous and manually intensive process that takes up to five days assuming everything goes smoothly.

Stablecoins circumvent banks and can be sent instantaneously from one wallet to another. Using a blockchain powered network, operators can offer a much faster, cheaper, and more transparent service to users. Additionally, these assets allow the remitters to have greater control of how the money is being spent. For example, with the use of smart contracts, remittance senders will be able to ensure certain expenses or family medical bills are prioritized.

Remittances represent a lifeline to more than one billion people globally. With such a large Total Addressable Market (TAM), it is startling that more innovation has not taken place to update payment rails.

Governments are not alone in their quest to solve these age-old problems with digital currencies. In typical innovative fashion, much of the development is being done in the private sector. Facebook’s digital payment experiment, Libra, has sparked and intensified the necessity of reimagining the way money moves. Rather than running up against an impossible task of establishing a one world currency, Facebook wants to be an aggregator of sorts; they will include single currency stablecoins (read CBDCs) in addition to their own Libra coin. They have plenty of regulatory hoops to jump through but it is encouraging that they are spearheading this initiative to make global finance more transparent and accessible.

Posed another way, if money and payment systems were invented today to meet the needs of the digital world we live in, what would they look like?

They certainly would not resemble the existing infrastructure. The world needs a trusted, efficient, and interoperable form of payment that can deliver on the premise of an internet native currency. The only viable solution is a global, transparent, interoperable, real-time, cheap, protocol for individuals and businesses to move money around the globe seamlessly. Transferring money throughout the world should be as easy as sending a text message or sharing a picture.

Until next time ✌️,

AC

If you liked this post, share it with your friends.

If you didn’t like this post, share it with your friends, maybe they will.

Some governments - especially those with weak currencies would not want money transfer to be that easy. They would like the system to have as much friction as possible.